- The Bitcoin Observer

- Posts

- Banks Onboard, Bitcoin Onward: Legacy Finance Embraces Bitcoin Amid "Uptober" Turbulence

Banks Onboard, Bitcoin Onward: Legacy Finance Embraces Bitcoin Amid "Uptober" Turbulence

Bitcoin Insights For Professionals

Banks Onboard, Bitcoin Onward: Legacy Finance Embraces Bitcoin Amid "Uptober" Turbulence

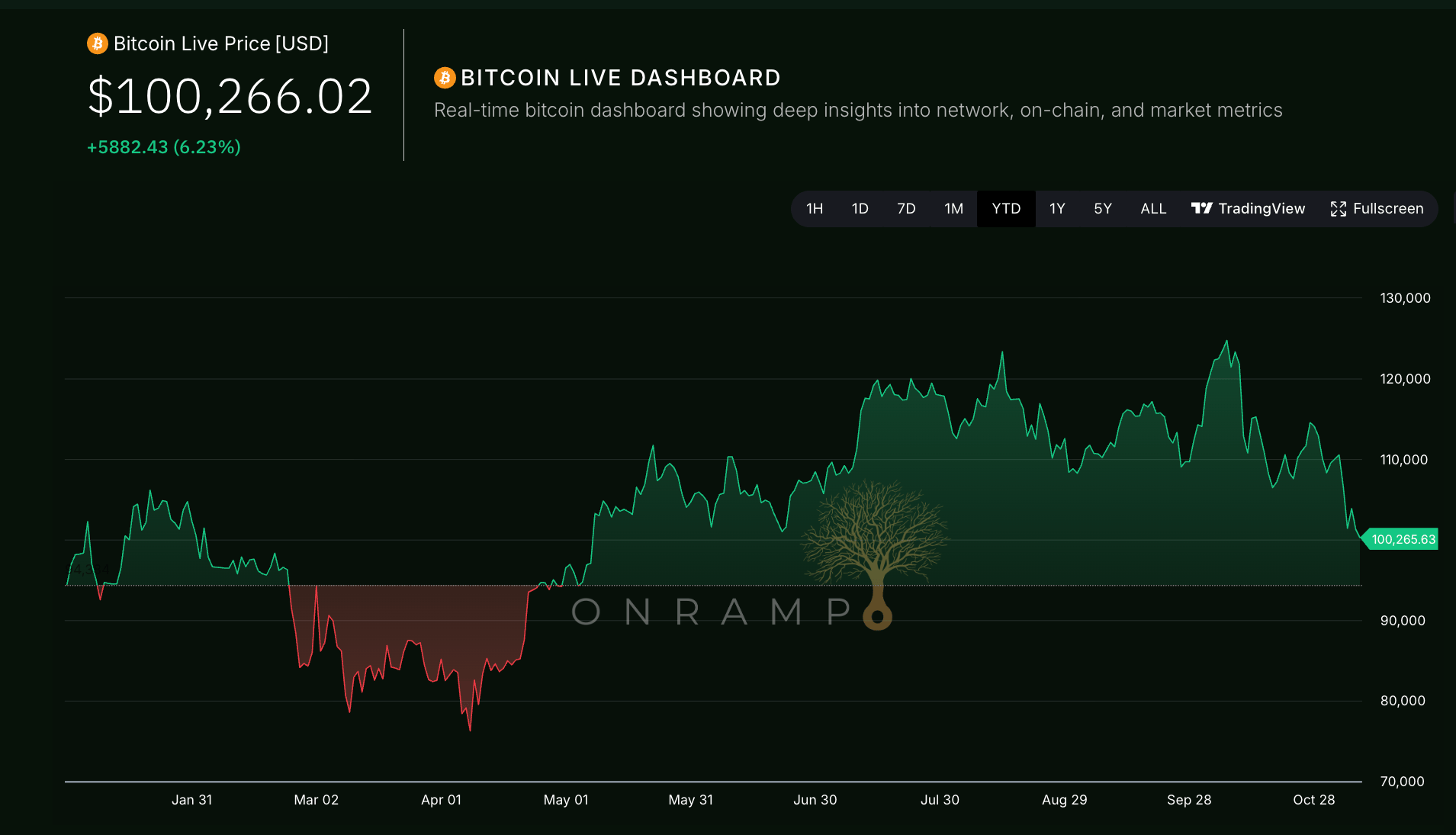

Bitcoin’s October defied its usual “Uptober” narrative. Despite an early surge to new all-time highs, the month closed in the red, the first time in several years. After briefly climbing above $125K in early October, Bitcoin was hit by a violent macro-driven sell-off mid-month, plunging below $100K for the first time since summer.

Though the move rattled markets, it did not unravel them. Bitcoin has since rebounded and is consolidating around the $100K mark, as of early November.

This roller coaster underscored a critical shift in market structure: major institutions and long-term holders are now providing a backstop. Corrections that once spiraled into brutal bear markets are increasingly viewed as buying opportunities for strategic capital, not exit signals. Unlike prior cycles dominated by retail euphoria and capitulation, today’s volatility is increasingly absorbed by sovereign funds, corporate treasuries, and ETF allocators.

This Month’s Big Story: Financial Institutions Get Off the Sidelines

🏦 After years of hesitation, legacy finance is stepping in. October saw a flurry of announcements from major banks, brokerages, and asset managers rolling out Bitcoin trading, custody, and advisory services. This shift signals that Bitcoin is no longer a fringe asset, but a core consideration in client portfolios.

This wave reflects a broader demand shift: clients are asking for Bitcoin, and financial institutions are responding with integrated solutions across execution, custody, and reporting.

Effective Oct 15, Morgan Stanley’s financial advisors can now pitch Bitcoin ETFs to any client (not just the ultra-affluent)

JPMorgan Chase announced it will allow institutional clients to use their Bitcoin holdings as collateral for loans, globally, by year end. Goldman Sachs has already been doing the same, and now JPMorgan’s move marks a watershed for banking.

In the consumer banking sphere, U.S. banks have reversed course on Bitcoin: companies like SoFi reintroduced in-app trading, and PNC Bank partnered with Coinbase to let customers buy and sell Bitcoin.

Many other banks are following suit, and these developments illustrate that traditional finance is actively integrating Bitcoin into its services.

Sovereign & Pension Funds Demand

Governments and state-backed funds played a key role this month. Most notably, Luxembourg’s Intergenerational Sovereign Wealth Fund (FSIL) announced it will allocate 1% of its portfolio to Bitcoin, via spot ETFs. This makes Luxembourg the first Eurozone government to put real money into Bitcoin, reflecting confidence in it as an emerging reserve asset.

Pension funds and endowments in the U.S. and Europe are also reported to be quietly adding Bitcoin exposure via the new ETF vehicles. Meanwhile, traditional “smart money” continues to accumulate on the corporate front (see below).

Together, these moves by sovereign and institutional buyers signal a structural shift: Bitcoin demand is no longer predominantly retail, but increasingly backed by long-horizon allocators.

Corporate & Institutional Moves

Several major firms further deepened their Bitcoin positions. Strategy (formerly MicroStrategy) financed new purchases of Bitcoin in October and November, the latest being an addition of 397 BTC at an average price around $114,771, bringing its total holdings to 641,205 BTC (over $74 billion).

ETF Flows: After ~$1.3B in redemptions amid early-November volatility, ETF inflows have slowed sharply, signaling temporary profit-taking by institutions, yet cumulative allocations now exceed $60 B, underscoring sustained adoption by pensions, family offices, and sovereign investors despite short-term consolidation.

Bitcoin’s Price Action Explained

Fed Rate Cut (Oct 29): The Fed delivered another 25 bp cut. Lower real yields and renewed risk appetite helped underpin markets, though Powell cautioned that without data (due to a U.S. shutdown) further cuts may be paused.

📈 October All-Time High: On Oct 5, Bitcoin surged to ~$125K, its new all-time , driven by ETF inflows, and sovereign demand. The breakout was structural, large investors (sovereigns, pensions, corporations) were net buyers rather than speculative retail.

📉 Trade War Shock (Oct 9–10): President Trump’s 100% tariff threat on Chinese imports roiled markets. Bitcoin fell ~8.4% to $104,782, part of a broader $400B crypto market drop (an historic one-day drawdown). Crucially, this dip was largely absorbed by long-term holders and institutions.

📊 Consolidation (Nov 4): By early November, Bitcoin traded ~ $100K, down ~20% from its peak. Funding rates remain low, suggesting the move is spot-driven. Volatility has become an entry point for allocators, not a panic exit, and price action reflects cautious positioning as allocators buy during pullbacks.

Market Snapshot

Key Bitcoin Metrics as of November 6, 2025:

🔶 Price: $100,266 USD

🔶 Market Cap: $2.03 Trillion USD

🔶 All-Time High: $126,200 USD (Oct 5, 2025)

🔶 Dominance: 59.8%

🔶 Satoshis per $1: ~997 sats

📈 Onramp Terminal Metrics

Onramp Terminal

Closing Thought: Market Depth Over Hype

October served as a test: can Bitcoin sustain a structural bull case when sentiment turns and volatility returns?

The answer, increasingly, is yes.

Not because of headlines or influencers, but because sovereigns, corporates, and financial institutions are slowly but methodically integrating Bitcoin into their operations, portfolios, and client offerings.

Bitcoin’s floor is no longer psychological. It’s architectural.

Podcast Episodes

🔔 Subscribe for Expert Insights on Bitcoin For Professionals!

We break down Bitcoin, investment, and finance for HNWIs, family offices, and investors who want to stay ahead in today’s evolving markets.