- The Bitcoin Observer

- Posts

- Big Money Bids Bitcoin: Institutions Double Down Amid November’s Dip

Big Money Bids Bitcoin: Institutions Double Down Amid November’s Dip

Bitcoin Insights For Professionals

Big Money Bids Bitcoin: Institutions Double Down Amid November’s Dip

📉 Bitcoin’s November extended October’s turbulence, but this time institutional capital took center stage.

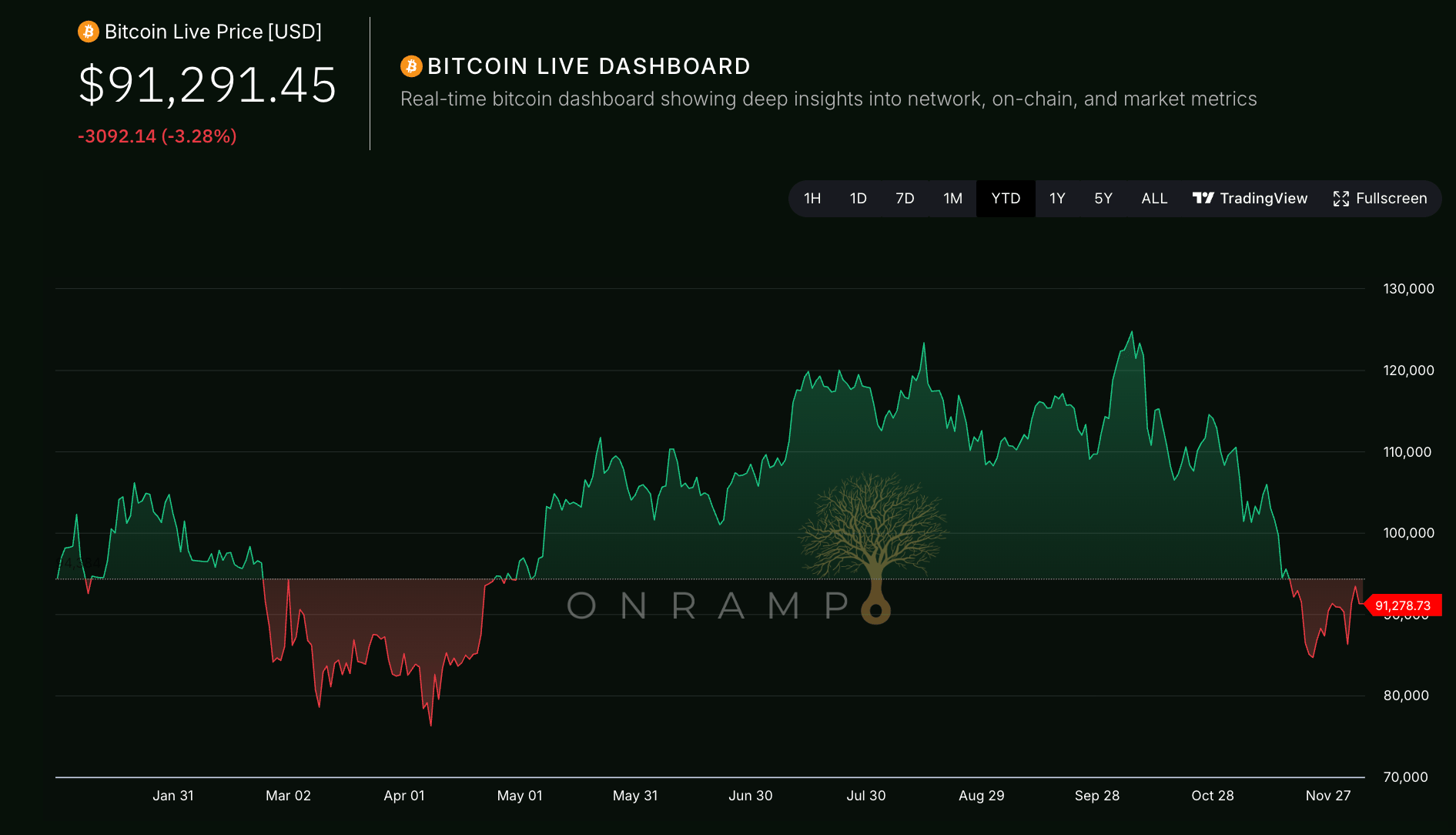

After stabilizing around $100K in early November, a mid-month sell-off pushed Bitcoin down nearly 36% from its peak, briefly under $85K, its lowest price since April. Yet what might have spiraled into a panic in past cycles instead saw large players buying the dip. Long-term investors, sovereign entities, and corporate treasuries absorbed the selling, providing a floor under the market. By early December, Bitcoin had rebounded to consolidate above the $90K range.

The message seems clear: unlike the retail-driven volatility of prior eras, today’s pullbacks are increasingly viewed as strategic entry points for deep-pocketed believers rather than exit signals.

This Month’s Big Story: Mainstream Finance Deepens Bitcoin Integration

💼 Bank of America will now let its 15,000+ advisers recommend 1–4% digital asset allocations, with exposure via major spot Bitcoin ETFs. CIO Chris Hyzy called it appropriate for “volatility-tolerant” clients, a major shift from the bank’s prior caution.

📊 Vanguard quietly reversed its anti-crypto stance, opening up access to Bitcoin ETFs for its vast client base. A seismic shift from 2024’s position, it shows how fast mainstream adoption is moving.

📈 JPMorgan launched structured notes tied to IBIT, offering 1.5× upside with limited downside protection. It also announced a Bitcoin collateral loan program for institutions, expanding on earlier crypto ETF acceptance.

🚫 Jack Mallers vs. JPMorgan: Mallers revealed JPMorgan abruptly closed all his accounts, with no explanation. The Bitcoin community accused the bank of hypocrisy, offering Bitcoin to clients while debanking Bitcoin builders. Despite regulatory protections, Operation Chokepoint 2.0 may still be alive.

📖 How Nine Days Redefined Bitcoin Ownership: Absorbed by Institutions

📖 JP Morgan Cuts Off Strike CEO Jack Mallers, Sparking Debanking Debate

Sovereign & Pension Funds Demand

🇺🇸 Texas made history with its first $5M Bitcoin treasury buy, part of a planned $10M reserve. The buy was made via IBIT ETF, with self-custody planned. It’s a small but historic step toward state-level Bitcoin adoption.

🎓 Harvard Endowment tripled its IBIT stake to $443M in Q3, now its largest U.S. listed asset. The university’s top holdings now include Bitcoin and gold ETFs, hedging against inflation and showing growing conviction.

🌍 Abu Dhabi’s Al Warda Investments, part of Mubadala, increased IBIT exposure to $517M, a +230% jump in Q3. These sovereign flows are quietly building Bitcoin’s price floor.

📉 Spot Bitcoin ETFs saw ~$1.17B in outflows mid-November, mostly from profit-taking. Yet cumulative allocations top $60B, and BlackRock’s IBIT alone holds ~776K BTC. Institutions are rebalancing, not abandoning ship.

📖 Texas Becomes First US State to Buy Bitcoin

📖 Harvard Boosts Bitcoin Holdings Through BlackRock ETFs

📖 Abu Dhabi Investment Council Triples Bitcoin ETF Stake

Corporate & Institutional Moves

📦 Strategy Inc. (formerly MicroStrategy) now holds 650,000 BTC, after buying 130 more during the dip. It also created a $1.44B USD reserve to weather volatility, using proceeds from new share issuance. CEO Phong Le called the USD cushion a key step in “playing our role in the Bitcoin ecosystem.”

🧾 JPMorgan’s bear note resurfaced six-week-old MSCI index exclusion risks for MSTR, sparking accusations of market manipulation. Critics say JPM created a panic around passive index selling. Michael Saylor said: “We’re not a fund. We’re a business with $500M in annual revenue.” Backlash exploded: Max Keiser, Grant Cardone, and others called for a JPMorgan boycott. Ironically, this came the same month JPMorgan launched Bitcoin-linked products.

💼 Beyond the headlines: BlackRock, Goldman, Coinbase, and MSCI all made moves deepening Bitcoin’s corporate footprint, from structured products to lobbying for crypto treasury treatment. Bitcoin is now a fixture in boardroom planning.

📖 Strategy Dashboard

📖 JP Morgan predicts Bitcoin Price Could Reach 240,000$ and Introduces new Bitcoin-tied Product

📖 JP Morgan Faces Boycott Calls After Strategy (MSTR) Stock Crash

Market Snapshot

Key Bitcoin Metrics as of November 6, 2025:

🔶 Price: $91,291 USD

🔶 Market Cap: $1.82 Trillion USD

🔶 All-Time High: $126,200 USD (Oct 5, 2025)

🔶 Dominance: 58.7%

🔶 Satoshis per $1: ~1,095 sats

📈 Onramp Terminal Metrics

Onramp Terminal

Closing Thought: Institutional Floor Replaces Retail Hype

November proved Bitcoin’s buyer of last resort is no longer retail. It’s Harvard, Texas, and sovereign funds. ETF outflows came, and were met with bids.

Corrections now meet capital.

Bitcoin’s integration into legacy finance is clear. Banks issue loans on it. States hold it. Endowments weigh it alongside gold.

⚒️ Bitcoin is now architectural, not aspirational. It’s part of finance’s foundation, slowly becoming less volatile, more widely held, and increasingly entrenched.

Podcast Episodes

🔔 Subscribe for Expert Insights on Bitcoin For Professionals!

We break down Bitcoin, investment, and finance for HNWIs, family offices, and investors who want to stay ahead in today’s evolving markets.