- The Bitcoin Observer

- Posts

- Bitcoin Hits $123K as Governments and Institutions Step In

Bitcoin Hits $123K as Governments and Institutions Step In

Bitcoin Insights For Professionals

Bitcoin Hits New All-Time High. Sovereigns, States, and Institutions Step In.

Bitcoin crossed $123,000 for the first time in July, a new all-time high, propelled by fresh U.S. legislation, ETF inflows, and unprecedented sovereign-level adoption.

Governments are no longer observing from the sidelines, they’re buying, legislating, and holding Bitcoin. In parallel, corporate treasuries are swelling, ETFs are absorbing supply, and regulatory green lights are coming into focus.

Let’s break it down.

This Quarter’s Big Story: Governments Are Holding Bitcoin — and Not Selling

For the first time, a G7 nation has declared Bitcoin a strategic reserve asset.

🇺🇸 United States: A Strategic Bitcoin Reserve

A March Executive Order created a U.S. Strategic Bitcoin Reserve (SBR) holding over 213,000 BTC, sourced from law enforcement seizures.

🔸 The reserve is prohibited from liquidation, and future Bitcoin purchases are encouraged through budget-neutral mechanisms.

🔸 A bipartisan BITCOIN Act was introduced to formalize management of the reserve.

🔸 The U.S. Treasury now holds more Bitcoin than any other government.

🔸 The upcoming U.S. Treasury Digital Assets Report (due July 30) is expected to outline long-term federal policy on Bitcoin reserves, custody infrastructure, and stablecoin frameworks, and may offer additional clarity on sovereign BTC strategy.

📖 Executive Order summary

📖 Bitcoin Act (Senate Bill 1941)

🌎 Other Nation-State Moves

El Salvador – BTC holdings now worth over $760M.

Russia & Iran – Using domestically mined BTC for cross-border trade.

Bhutan – Mining 55–75 BTC/week using hydropower through its sovereign wealth fund.

China – Holds ~194,000 BTC from criminal seizures; officially silent but holds largest sovereign stash after the U.S.

Ukraine – Received ~46,000 BTC in wartime crypto donations.

📖 Bhutan’s sovereign Bitcoin mining revealed

State Treasuries and Public Funds: Bitcoin Goes Local

🏛️ New Hampshire

Passed law allowing up to 5% of treasury reserves to be held in Bitcoin via direct custody or ETFs.

📖 Read more

🌵 Arizona

Created a digital asset reserve fund including unclaimed Bitcoin.

May stake, hold, or liquidate after designated holding periods.

📖 Full story

🤠 Texas

Texas Strategic Bitcoin Reserve and Investment Act has been signed into law.

Establishes a state-managed fund that will hold Bitcoin as part of the state’s long-term financial assets.

$10 million to be allocated and used to purchase Bitcoin for the reserve.

📖 Full story

🏛️ Other States

North Carolina, and Louisiana are advancing similar treasury allocation bills.

Wyoming’s bill was voted down, but discussions continue.

📖 Full story

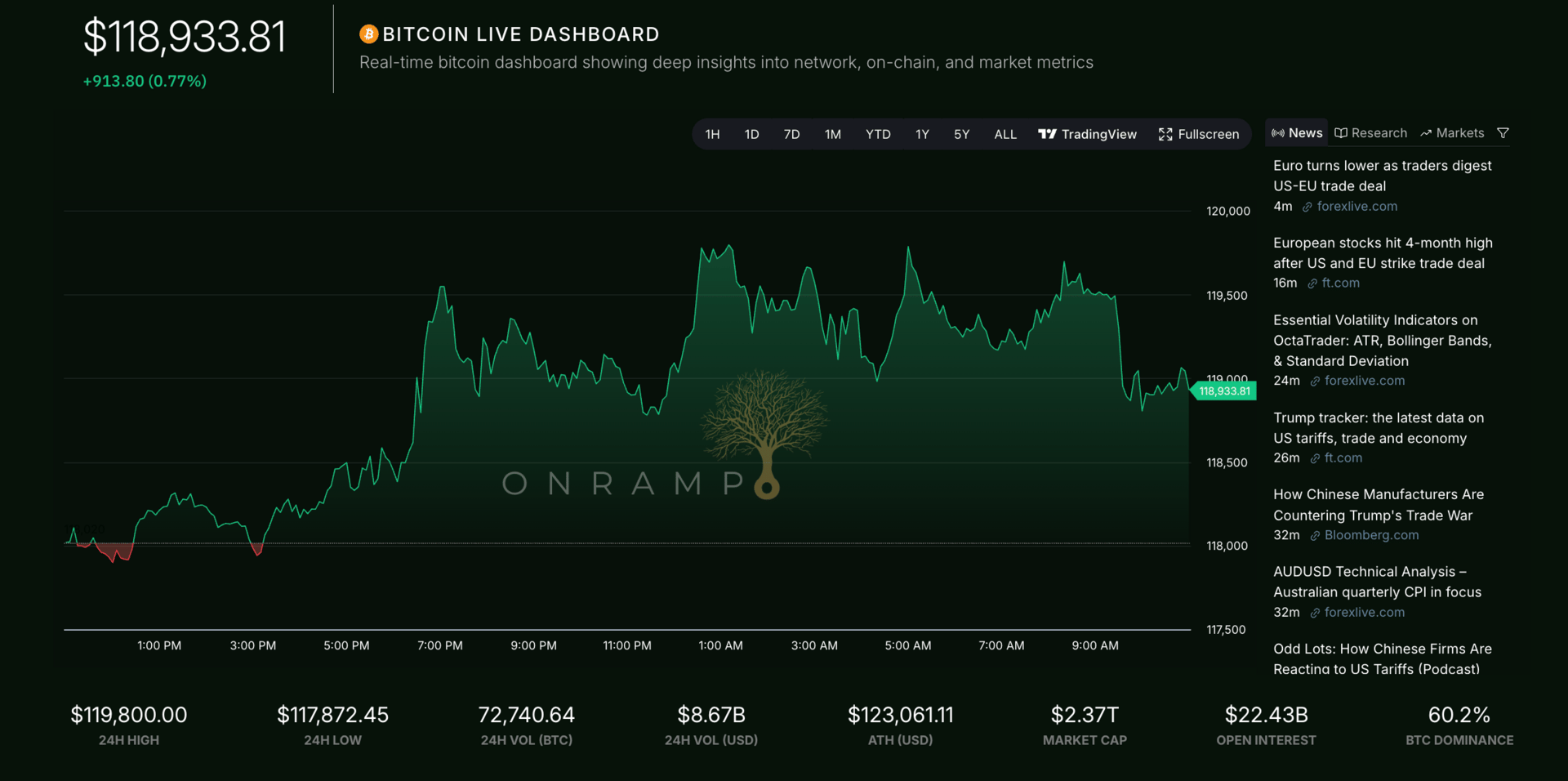

Market Snapshot

Key Bitcoin Metrics as of July 25, 2025:

🔶 Price: $118,934 USD

🔶 Market Cap: $2.3 Trillion USD

🔶 All-Time High: $123,153 USD (July 14, 2025)

🔶 Dominance: 60%

🔶 Satoshis per $1: ~841 sats

📈 Onramp Terminal Metrics

Onramp Terminal

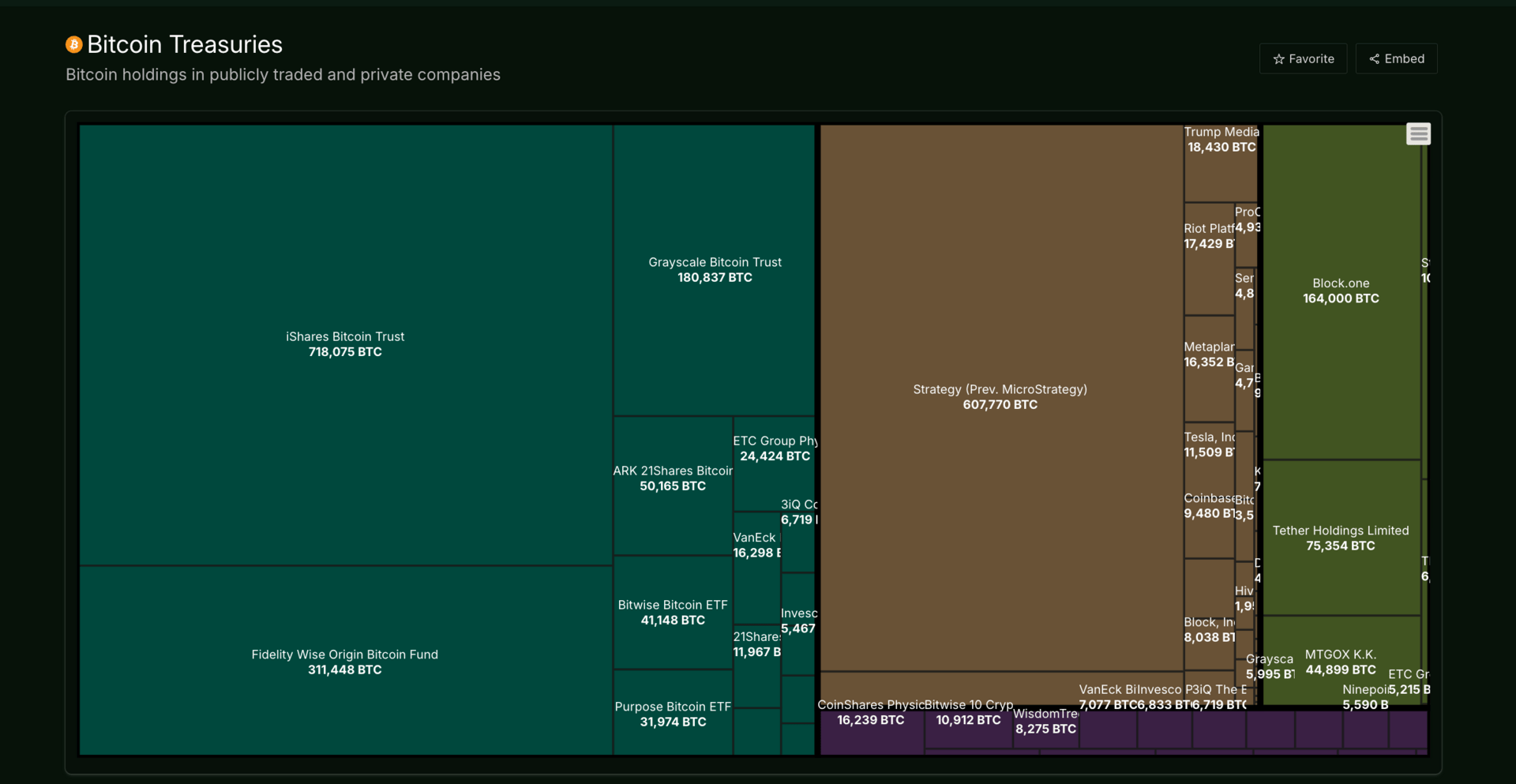

Corporate Bitcoin: Over 859,000 BTC Held Publicly

Strategy (formerly MicroStrategy) now holds 607,770 BTC (~2.9% of all BTC) worth over $70B.

🔸 Average purchase price: ~$71K; latest acquisition: 6,220 BTC for $739.8M.

🔸 Stock up 3,500% since 2020; seen as a high-beta BTC proxy.

📖 Strategy’s updated treasury data

Other Public Companies Holding BTC

Tesla: 11,500 BTC

Marathon Digital: 46,000 BTC

Block (Square): 8,500 BTC

GameStop: 4,710 BTC (acquired Q2 2025)

Trump Media: $2B in BTC & related securities

ETF & Institutional Update: Over $150B AUM in Bitcoin ETFs

BlackRock’s IBIT

718,075 BTC held

Now BlackRock’s most profitable ETF

💼 Other Highlights

Spot Bitcoin ETFs now hold ~1.27M BTC (~6.1% of supply).

Global crypto ETF inflows hit $4B in one week (July’s record).

Asia’s first spot BTC ETFs launched in Hong Kong to strong demand.

Coinbase now custodies ~2.3M BTC — making it the largest institutional Bitcoin custodian globally.

Sovereign Wealth Funds & Pensions Quietly Allocating

Mubadala (UAE) – $437M in BTC ETF positions confirmed.

Wisconsin Pension Fund – ~$600M in BTC via ETF shares.

Ohio pension funds, Canadian endowments, UAE family offices are gaining exposure via ETFs or MSTR.

📖 Sovereign wealth enters Bitcoin

Regulation & Infrastructure: U.S. Turns Pro-Crypto

✅ Regulatory Progress

GENIUS Act signed into law: stablecoins now federally regulated with 1:1 reserve mandates.

CLARITY Act redefines digital assets & reduces SEC overreach.

Anti-CBDC Act bans a Federal Reserve retail digital dollar.

📖 GENIUS Act summary

🏦 Custody & Infrastructure

Banks no longer need prior approval to custody crypto.

OCC rescinded restrictive guidance; banks encouraged to offer regulated crypto services.

Coinbase, BNY Mellon, and Deutsche Bank ramp up institutional custody offerings.

📖 OCC Interpretive Letter 1183

Closing Thought: Bitcoin Is No Longer Fringe — It’s Foundational

From Bhutan to BlackRock, and from Arizona to Abu Dhabi, Bitcoin is no longer an outsider asset.

It is being integrated into sovereign balance sheets, retirement portfolios, corporate treasuries, and public funds.

The implications for capital allocators are clear:

🔸 Bitcoin is becoming a strategic reserve asset

🔸 ETF flows are driving structural demand

🔸 Custody decisions will define who really owns it

The question is no longer “Will sovereigns adopt Bitcoin?”

It’s: “How will you position before the next one does?”

If You’re Asking the Right Questions, Let’s Talk

We work with individuals, institutions, and family offices to help them understand:

The difference between holding Bitcoin vs. having exposure.

The hidden risks in custodial ETF structures.

The path toward resilient, long-term ownership.

The Bitcoin-native solutions that exist today.

Whether you’re a passive ETF investor, a CIO navigating asset allocation, or someone rethinking custody from first principles, we can help. Book a consultation here.

Why Custody Matters. Now More Than Ever

For the first time in history, trillions in capital are considering Bitcoin.

But the question is not just “how much Bitcoin do I own?”

It’s:

Who controls it?

Where is it custodied?

What happens in the event of an institutional failure?

Are my assets bankruptcy remote?

Can I access my holdings 24/7 — or am I depending on office hours?

These questions aren’t just technical — they’re existential for allocators, institutions, and HNWIs building for the next 10, 20, or 50 years.

There Is a Better Way

We believe the future of Bitcoin custody looks different.

Multi-institution custody — where keys are distributed across regulated entities, ensuring no single point of failure.

Structures where clients have ultimate control and can verify their holdings cryptographically.

Solutions that blend institutional oversight with Bitcoin-native principles.

This is not about abandoning ETFs.

It’s about understanding their limitations — and building beyond them.

Podcast Episodes

🔔 Subscribe for Expert Insights on Bitcoin For Professionals!

We break down Bitcoin, investment, and finance for HNWIs, family offices, and investors who want to stay ahead in today’s evolving markets.