- The Bitcoin Observer

- Posts

- Ivy League Endowments, Whales, Powell, and the $110K Line

Ivy League Endowments, Whales, Powell, and the $110K Line

Bitcoin Insights For Professionals

Ivy League Endowments, Whales, Powell, and the $110K Line

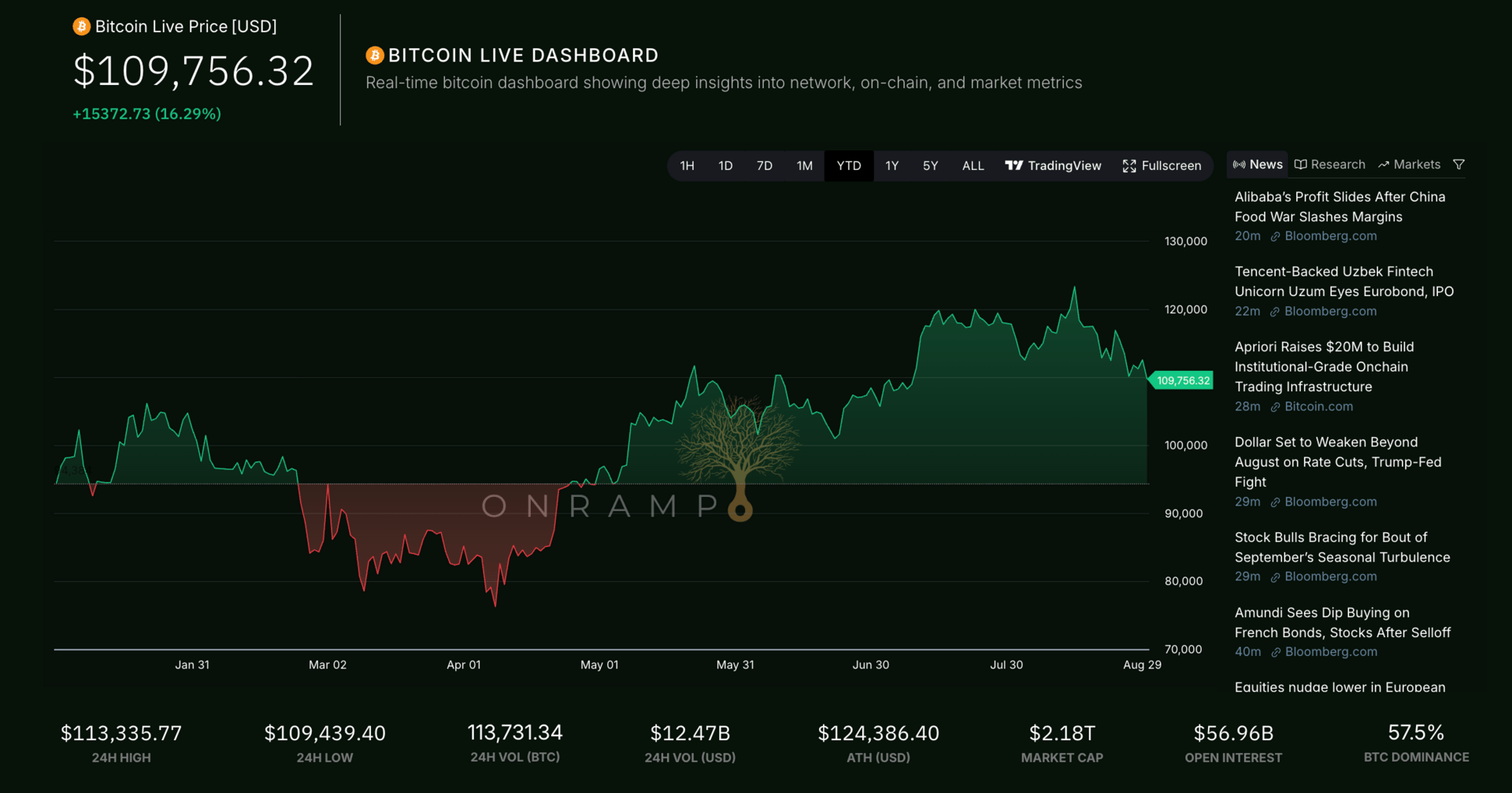

Bitcoin hit a new all-time high of $124,000 on August 14, only to stumble back toward $110,000 after a volatile two weeks.

A weekend whale sell-off, Powell’s Jackson Hole remarks, and renewed ETF outflows tested investor conviction. By August 29, Bitcoin was stabilizing around $110K, down ~11% from the peak.

A reminder that volatility is alive, but structural demand remains strong, including from Harvard and Brown Universities, two of the most sophisticated institutional investors in the world.

Let’s break it down.

This Month’s Big Story: Volatility Returns

🎙 Powell’s Speech (Aug 22)

At Jackson Hole, Fed Chair Jerome Powell signaled rate cuts may be coming, citing slowing labor markets despite elevated inflation. Markets cheered: stocks rallied, yields fell, and Bitcoin briefly spiked nearly 4% to ~$117K, gains that were quickly erased by the coming weekend selling.

📉 Weekend Whale Sell-Off (Aug 24)

Thin weekend liquidity, profit-taking, and ETF outflows set the stage for turbulence. On Aug 24, a dormant whale sold 24,000 BTC (~$2.7B), triggering ~$550M in liquidations and knocking BTC down ~2.5% to the low $112Ks.

⚠️ Testing $110K (Aug 25)

By Aug 25, Bitcoin briefly broke below $110K for the first time in two months. Analysts now view this as a critical support level.

Unlike past cycles where drawdowns often exceeded 50%, today’s corrections are far more contained, evidence that structural demand is underpinning the market.

University Endowments Step In

Harvard University disclosed a $116.7M stake in BlackRock’s IBIT Bitcoin ETF, making Bitcoin its 5th largest holding, bigger than Nvidia or Google.

Brown University nearly doubled its Bitcoin ETF stake to ~$13M.

Earlier pioneers like Emory University continue to hold Bitcoin via trusts.

This marks a defining moment in institutional allocation. Leading endowments have signaled that sound money is no longer peripheral but belongs at the core of modern portfolios. The allocations may be modest, but the precedent they set is profound.

Corporate & Institutional Moves

Strategy (formerly MicroStrategy) bought the dip: +3,081 BTC ($357M). Total holdings now 632,457 BTC (~3% of supply).

Marathon Digital: Reserves passed 50,000 BTC, showing continued miner accumulation.

ETF Flows: After July’s record inflows, August saw ~$1.2B in net outflows during the dip, but long-term allocators, including Middle Eastern sovereign wealth funds and U.S. pensions, stepped in.

Asia in Focus

Hong Kong: Spot Bitcoin & Ethereum ETFs (approved in 2024) continue to gain traction; the city’s new Stablecoins Ordinance (2025) cements its role as a global crypto hub.

Japan: Finance Ministry affirmed crypto assets can be part of diversified portfolios, a landmark for a G7 government.

📖 Coindesk

Regional Wealth Trends: Asian family offices are boosting crypto allocations to ~5% of portfolios, with younger generations leading. Hong Kong licensed exchanges report +85% user growth YoY, and the Bitcoin Asia 2025 conference drew 15,000 attendees.

Market Snapshot

Key Bitcoin Metrics as of August 29, 2025:

🔶 Price: $109,756 USD

🔶 Market Cap: $2.2 Trillion USD

🔶 All-Time High: $124,500 USD (Aug 14, 2025)

🔶 Dominance: 58%

🔶 Satoshis per $1: ~911sats

📈 Onramp Terminal Metrics

Onramp Terminal

Closing Thought: Volatility Is a Feature, Not a Bug

August underscored Bitcoin’s duality:

Volatile in the short-term thin liquidity, leveraged traders, and macro shocks can push prices down fast.

Resilient in the long-term sovereigns, miners, pensions, endowments, and Asian institutions are steadily building exposure.

For allocators, the key is not whether Bitcoin will swing, but who owns it when it does and how securely it is custodied.

Bitcoin is no longer fringe. It’s foundational.

Podcast Episodes

🔔 Subscribe for Expert Insights on Bitcoin For Professionals!

We break down Bitcoin, investment, and finance for HNWIs, family offices, and investors who want to stay ahead in today’s evolving markets.