- The Bitcoin Observer

- Posts

- Wall Street’s Bitcoin Bet

Wall Street’s Bitcoin Bet

Bitcoin Insights For Professionals

What the Institutional Stampede Means — and What Most Are Missing

A New Era of Bitcoin Exposure

Wall Street is going all-in on Bitcoin. But in the rush for exposure, something critical is being overlooked: custody. Today, we unpack the ETF stampede — and the hidden risks most allocators haven’t considered.

In January 2024, something historic happened:

U.S. spot Bitcoin ETFs were approved after more than a decade of resistance.

In doing so, regulators didn’t just approve a financial product.

They invited Wall Street into Bitcoin, and Wall Street showed up in force.

In the weeks that followed, capital flooded in.

BlackRock. Fidelity. Ark. Franklin Templeton. Invesco. VanEck.

Over a dozen issuers. Billions in inflows.

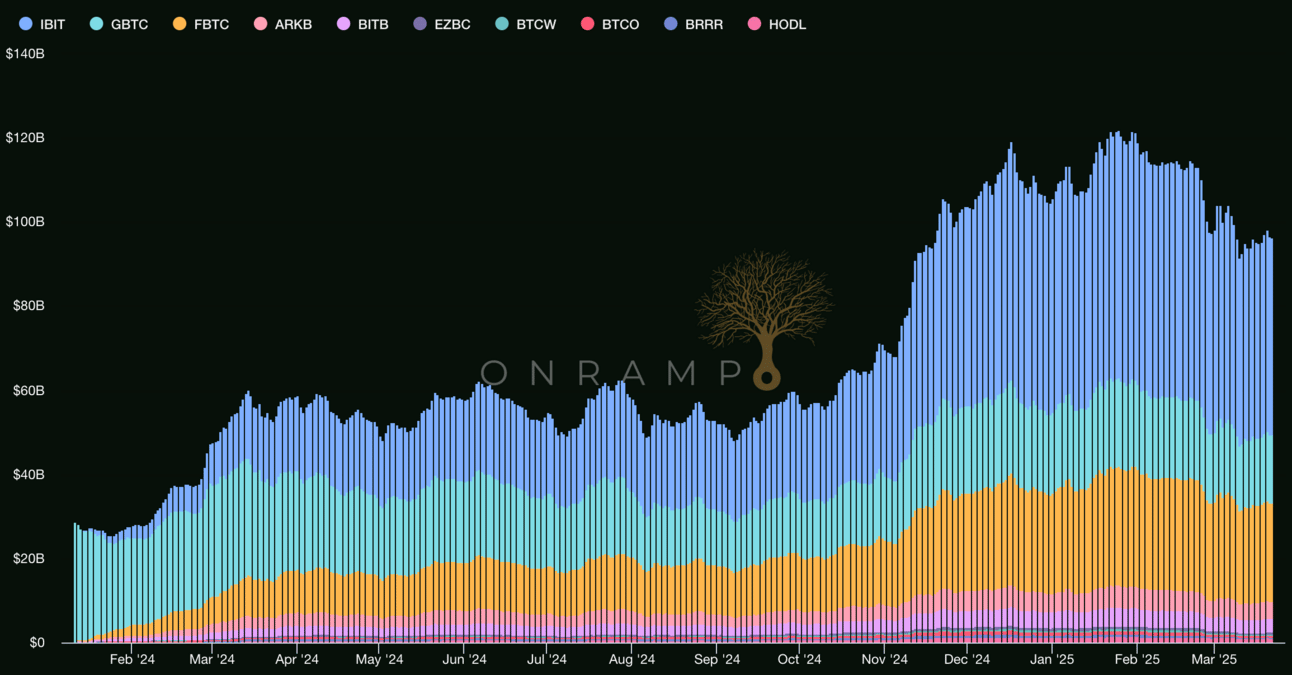

Today, as of March 2025, more than $130 billion sits in U.S. spot Bitcoin ETFs — a figure that would have seemed unthinkable just a year ago.

The Stampede, Visualized

ETF Ticker Breakdown:

IBIT – BlackRock

GBTC – Grayscale

FBTC – Fidelity

ARKB – Ark Invest / 21Shares

BITB – Bitwise

EZBC – Franklin Templeton

BTCW – WisdomTree

BTCO – Invesco / Galaxy

BRRR – Valkyrie

HODL – VanEck

IBIT (BlackRock) alone now holds over 579,000 BTC — the fastest-growing ETF in U.S. history. Combined with FBTC and GBTC, we’re witnessing hundreds of thousands of BTC moving into custodial vaults under the ETF wrapper.

Wall Street has spoken:

Bitcoin is now an institutional asset class.

But Exposure ≠ Ownership

This growth is impressive. But it comes with critical structural caveats that most investors — and even institutions — still overlook.

Bitcoin ETFs give you price exposure, not ownership.

You can’t move it. You can’t spend it. You can’t custody it.

And perhaps more importantly:

You don’t control it. Someone else does.

Most ETF investors don’t know that nearly all of this Bitcoin — across nearly all ETFs — is held by a single custodian.

One Custodian to Hold Them All

Most ETF investors don’t realise a crucial fact:

Nearly all of this Bitcoin — across nearly all ETFs — is held by a single custodian.

That custodian is Coinbase.

Here’s what that centralisation looks like in numbers:

Coinbase Custody controls over 2.27 million BTC

More than 800,000 BTC of that is held on behalf of ETFs and ETPs

Coinbase holds custody for 15+ ETF providers

That’s ~4% of the entire circulating Bitcoin supply

Coinbase holds 4x more BTC than MicroStrategy

Let that sink in.

Bitcoin was built to eliminate central points of failure.

Yet, through ETFs, we are recentralizing Bitcoin into a single chokepoint.

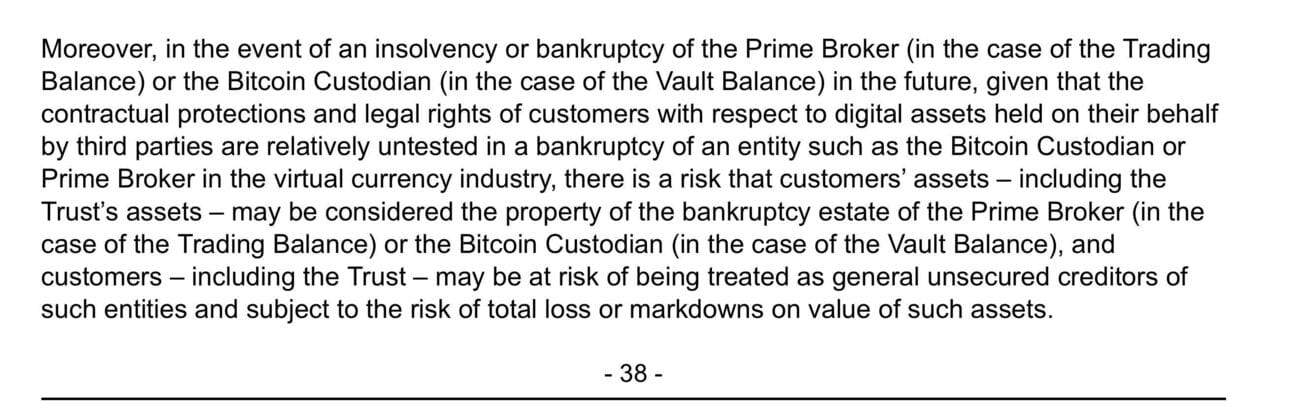

BlackRock’s own ETF filing makes this clear:

“There is a risk that customers’ assets… may be considered the property of the bankruptcy estate of the... Bitcoin Custodian… and customers… may be at risk of being treated as general unsecured creditors.”

In other words:

If Coinbase goes under — or is forced into insolvency, seizure, or legal dispute — ETF holders may find themselves at the back of the line, with no claim to the Bitcoin they thought they owned.

This is not a theoretical risk. It has happened before — in both traditional and digital markets:

MF Global (2011): A regulated commodities broker that commingled customer funds in omnibus accounts. When it collapsed, customer ownership was blurred, and assets were tied up in bankruptcy court.

Lehman Brothers (2008): Omnibus account structures and unclear asset segregation led to client funds being pulled into the bankruptcy estate — with recoveries taking years in some jurisdictions.

FTX (2022) & QuadrigaCX (2019): High-profile crypto exchange collapses where customer assets were mismanaged, inaccessible, or lost entirely — despite operating as both custodians and brokers.

Even regulated, capitalized entities are not immune.

Risk doesn’t always announce itself — and when it emerges, custody structure becomes the difference between resilience and ruin.

If You’re Asking the Right Questions, Let’s Talk

We work with individuals, institutions, and family offices to help them understand:

The difference between holding Bitcoin vs. having exposure.

The hidden risks in custodial ETF structures.

The path toward resilient, long-term ownership.

The Bitcoin-native solutions that exist today.

Whether you’re a passive ETF investor, a CIO navigating asset allocation, or someone rethinking custody from first principles, we can help. Book a consultation here.

Bitcoin, Repackaged by the Old System

There’s an irony here worth reflecting on:

Bitcoin was designed to eliminate counterparty risk.

ETFs reintroduce it.

Bitcoin was built for decentralisation.

ETFs cluster it into single points of failure.

Bitcoin empowers the individual and private organisations.

ETFs entrust Wall Street — again.

Bitcoin was designed to be bearer asset money, secured by individuals or distributed trust.

ETFs take that and repackage it into a centralized, regulated trust model — wrapped in familiar logos and legacy infrastructure.

This isn’t inherently bad — ETFs have opened access to millions.

But we must be clear: ETFs are a bridge, not the destination.

Why Custody Matters — Now More Than Ever

For the first time in history, trillions in capital are considering Bitcoin.

But the question is not just “how much Bitcoin do I own?”

It’s:

Who controls it?

Where is it custodied?

What happens in the event of an institutional failure?

Are my assets bankruptcy remote?

Can I access my holdings 24/7 — or am I depending on office hours?

These questions aren’t just technical — they’re existential for allocators, institutions, and HNWIs building for the next 10, 20, or 50 years.

There Is a Better Way

We believe the future of Bitcoin custody looks different.

Multi-institution custody — where keys are distributed across regulated entities, ensuring no single point of failure.

Structures where clients have ultimate control and can verify their holdings cryptographically.

Solutions that blend institutional oversight with Bitcoin-native principles.

This is not about abandoning ETFs.

It’s about understanding their limitations — and building beyond them.

Podcast Episodes:

🔔 Subscribe for Expert Insights on Bitcoin For Professionals!

We break down Bitcoin, investment, and finance for HNWIs, family offices, and investors who want to stay ahead in today’s evolving markets.